How to Read the Inverted Hammer Candlestick Pattern?

When a hammer appears, it is indicating that the market is trying to seek a bottom. Hammers suggest a probable surrender by sellers to create a bottom, which is accompanied by a price increase, indicating a possible price direction reversal. This occurs all at once, with the price falling after the open but regrouping to close around the open.

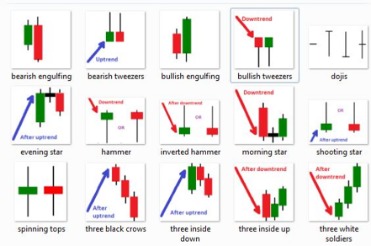

Hammer and inverted hammer candlestick patterns are a key part of technical trading, forming the building blocks of many strategies. A Hammer pattern accompanied by high trading volume suggests stronger buying pressure. Additionally, traders can use other technical indicators, like trendlines or moving averages, to confirm the pattern and the potential trend reversal. The answer is yes; an inverted hammer candlestick signals a short-term downtrend reversal or bullish reversal. The hammer candlestick is a bullish trading pattern that indicates a stock has reached its bottom and is about to reverse the trend. It indicates that sellers entered the market and drove down the price, only to be overwhelmed by buyers who drove the asset price up.

Inverted hammer chart pattern example

Some traders often wait for a confirmation candle, the formation of a big green candle after the hammer candlestick. An inverted hammer is a type of Japanese candlestick chart pattern used to predict a possible trend reversal. Therefore, this unique pattern can be interpreted as a bullish signal and offers traders entry levels for long buying positions. Here are the key takeaways you need to consider when using the inverted hammer candlestick pattern. When you add the RSI indicator to your charting platforms, you’ll be looking for a crossover around the 30 level and at the same time, the inverted hammer candlestick appears. Confirmation happens when the candle that follows the hammer closes above the hammer’s closing price.

As an example, we are opting for the first option, although it is a tad riskier. The green horizontal line signals our entry point – where the hammer closed. The red line is the low, against which we place a stop-loss difference between hammer and inverted hammer around pips beneath. It is important to note that neither of these two patterns is a direct trading signal, but a tool which generates a sign that the price action may reverse as a balance shift is occurring.

Is a Hammer Candlestick bullish?

In general, market participants tend to overreact at the beginning of a move, which means that prices often exceed fair value by some percentage before finally leveling off or correcting. Hence, trading the Inverted Hammer can be an effective way to capitalize on these overreactions. This is because it indicates the end of the downtrend and reversals in the markets can. Unlock our free video lessons and you will learn the exact chart patterns you need to know to find opportunities in the markets. Learn the exact chart patterns you need to know to find opportunities in the markets.

Five Basic Candlestick Patterns To Learn & Advance Your Day Trading Career Right Now – Advanced Micro Dev – Benzinga

Five Basic Candlestick Patterns To Learn & Advance Your Day Trading Career Right Now – Advanced Micro Dev.

Posted: Tue, 30 May 2023 16:09:32 GMT [source]

As a result, the next candle exploded higher as the bulls felt that the bears were not so dominant anymore. Hence, the inverted hammer should be seen as a testing field in this case. As soon as the bulls felt the bears’ weakness they reacted quickly to drive the price action and secure a major victory. Unlike the hammer, the bulls in an inverted hammer were unable to secure a high close, but were defeated in the session’s closing stages. Still, the mere fact that the buyers were able to press the price higher shows that they are testing the bears’ resolve.

Marubozu Candlestick Pattern: What Is and How to Trade

So, while both the inverted hammer and shooting star can be indicative of a potential trend reversal, some key characteristics distinguish them from each other. It is important to be aware of these distinguishing factors in order to interpret market signals correctly. Many bullish traders (who expect the market to go up) enter a trade after the formation of the hammer candlestick. As you can see in the EUR/USD 1H chart below, the inverted hammer bullish pattern occurs at the bottom of a downtrend and signals a trend reversal. In terms of the implication of the pattern – the inverted hammer is a clear bullish trend reversal pattern and helps traders identify a possible reversal. Another form of the candlestick with a small actual body is the Doji.

The key takeaway is the price closes nowhere near the low which indicates by the close of that specific candlestick, bulls were able to regain control. An inverted hammer is a bullish reversal pattern that can be seen in an uptrend. The inverted hammer candlestick indicates that the bears are losing power, and the bulls may take over soon. If you see this pattern, it might be time to consider buying the asset. However, remember that no single indicator is 100% accurate, so always do your own research before making any investment decisions.

What is the inverted hammer candlestick?

Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts. The bearish version of the Inverted Hammer is the Shooting Star formation that occurs after an uptrend. Prices moved higher until resistance and supply were found at the high of the day. The bulls’ excursion upward was halted and prices ended the day below the open.

At one point, the inverted hammer was created as the bulls failed to create a hammer, but still managed to press the price action higher. A Japanese rice trader called Munehisa Homma developed the idea of candlestick charts in the 18th century. Today, crypto traders use candlestick charts in their technical analysis to forecast what might happen next regarding asset prices. As with any candlestick pattern, you’ll want to confirm the new trend before you open your trade. You could do this by waiting a few periods to check that the upswing is underway, or by using technical indicators.

The closing price may be slightly above or below the opening price, although the close should be near the open, meaning that the candlestick’s real body remains small. If you’ve spotted a hammer candlestick on a price chart, you may be eager to make a trade and profit from the potential upcoming price movement. Before you place your order, let’s take a look at a few practical considerations that can help you make the most of a trade based on the hammer pattern. Remember, hammers are a single candlestick pattern which means false signals are relatively common – and risk management is imperative.

The Psychology behind the Inverted Hammer Candlestick Pattern

A doji is also called an indecisive candle as there is no specific indication/decision. In an inverted hammer, an upper shadow is created as the price of the security rises initially but closes near the opening price. It also helps to support the region and signals that the downtrend is over and all the short-selling positions should be closed now. HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

Forex Trading Strategies: Check Out Trend Following, Breakout, And … – Naija Nigeria News Gistmania

Forex Trading Strategies: Check Out Trend Following, Breakout, And ….

Posted: Wed, 31 May 2023 07:19:36 GMT [source]

However, when it appears at the top, an uptrend ends, and a downtrend begins. Check out the article “How to Read Candlestick Charts?” to learn more about candlestick patterns and how to identify them. One of the major drawbacks of this pattern is that it may not be useful in the long run.

The RSI is a popular trend reversal indicator that finds areas of overdemand or oversupply and may indicate a possible reversal. Usually, you’ll find this indicator on any charting software including the popular MetaTrader4. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives.

- Candlestick traders will typically look to enter long positions or exit short positions during or after the confirmation candle.

- Read on to learn more about one of the most significant candlestick patterns in trading – the inverted hammer candlestick pattern.

- A hammer is a candlestick formation generally occurring at the end of a downtrend/bearish market.

You should consider whether you can afford to take the high risk of losing your money. It is important to note that the Inverted pattern is a warning of potential price change, not a signal, by itself, to buy. Hammers are most effective when at least three or more declining candles precede them. A declining candle is defined as one that closes lower than the previous candle’s closing. Since the sellers weren’t able to close the price any lower, this is a good indication that everybody who wants to sell has already sold.