Advantages and disadvantages of investing in bonds Волфлайн Кэпитал Инвестиционный банкинг и Управление активами

Content

Individual bonds, bond funds, and stocks can all fluctuate in value over time. That said, if we buy a 5-year bond issued by Wal-Mart or an issuer of similar credit quality, we know exactly the amount of principal we will receive in five years. The same cannot be said for a stock or a bond fund, which could be either higher or lower at that point. As you might expect, a 10-CUSIP portfolio filled mostly with high yield corporate bonds could have a lower level of income security than a 30-CUSIP portfolio containing bonds of higher credit quality. However, when the fund manager sells the municipal bonds in the fund, it can generate a capital gain on which the investor might owe taxes (both federal and state taxes). These types of funds offer lower yields than corporate bonds since they come with a lower default risk, and the interest payments are tax-free.

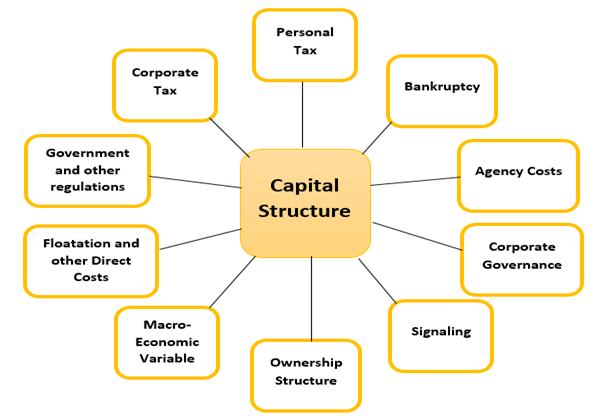

Figure 2 shows 218 high yield corporate bonds with YTMs of at least 8%. As shown below in the Security of Principal section, high yield bond default rates are higher than investment grade bond default rates. One caveat we will discuss later relates to the security of principal and income of individual corporate bonds vs. bond funds. In this case, we compare a portfolio of investment grade bonds with a similar duration to the leading investment grade bond funds (typically 6-7 years).

Advantages of Bonds

Bonds are generally less volatile than stocks, but they underperform stocks over the long term. Since 1926, big company stocks have given investors an average annual return of 10%, while government bonds have averaged between 5% and 6%. Investors buy bonds because they provide a safe, predictable income stream and can balance the risks posed by volatile but higher-yielding stocks and other, riskier portfolio assets. Investors also purchase bonds to earn interest on a regular basis until their original capital is returned. By combining their credit profiles, issuers can potentially qualify for larger loans and lower interest rates than they would be able to obtain individually.

You can buy federal bonds on TreasuryDirect, but that’s not the only way to buy them, and those aren’t the only types of bonds you can buy. A brokerage account will give you access to the widest selection of bonds, including corporate and municipal bonds, as well as exchange-traded funds (ETFs) and mutual funds that contain bonds. You can buy and sell them as often as you’d like on the secondary market.

Why Do Stocks Generally Outperform Bonds Over Time?

For borrowers, the main disadvantage is that it increases the risk of bankruptcy. Another advantage is that unsecured loans can be used for a variety of purposes, including working capital, equipment purchases, or even real estate investments. This flexibility can be helpful if you are not sure how you will use the funds from the loan.

With individual bonds, investors know the precise amount of, and date on which, they will be paid for each bond CUSIP they own. With bonds issued by highly profitable companies such as Apple and Wal-Mart, interest payments are generally money in the bank. There can be cases where companies file for Chapter 11 and cease making interest payments, but such cases are rare. We discuss corporate bond default rates in the Security of Principal section of this fixed income article.

This can be particularly beneficial for entities with limited resources or creditworthiness, as it allows them to access capital that may not have been available through individual debt financing. The primary purpose of a joint bond is to allow multiple entities to access capital by jointly issuing debt securities. These entities, which can be individuals, corporations, or governments, jointly guarantee the bond, ensuring that if one party defaults, the other parties are responsible for fulfilling the bond’s obligations. For a highly profitable company with a lot of cash such as Apple, large buybacks do not make it a near-term default risk. That said, businesses and consumer demands are always shifting, and today’s A-rated company can be tomorrow’s CCC-rated company.

What are the advantages and disadvantages of Bond Financing

In general, the longer your time horizon (i.e., the younger you are), the more risk you can take on. Therefore a portfolio weighted 80-90% in stocks and the rest in bonds or other assets is bearable. However, as your time horizon shortens, it is recommended to shift your allocation increasingly toward lower-risk bonds and reduce your allocation to stocks. Risk-averse investors looking to safely deploy their capital and take comfort in more structured payout schedules would be better off investing in bonds. Diversifying investments across both stocks and bonds, marries the relative safety of the bonds, with the higher return potential of stocks.

However, it is important to understand the risks and rewards before deciding if this type of financing is right for your company. The main advantage of mezzanine debt financing is that it can provide a company with the capital it needs to grow without giving up equity in the company. Mezzanine debt can also be used to finance the purchase of another company.

Disadvantages of bonds

On January 5, 2023, the company issued a warning that it has substantial doubt that it can continue as a going concern. Without underlying financial metrics, bond fund investors are limited to looking at a bond fund price chart to see if they are investing at a historically high or low price. Municipal bond issuers are exempt from federal securities registration and reporting requirements. Municipal bond issuers will typically issue an annual report; however, that report often takes over six months to complete. Corporate bond issuers are required to file quarterly financials on Form 10-Q within 40 days of quarter end and annual financials on Form 10-K within 60 days of year end.

While fixed income investments provide higher income security than stocks, there are some differences across corporate bonds, municipal bonds, and bond funds. The bonds held by these entities are often determined by bond ratings, as many of these investment vehicles have restrictions on owning bonds below a specific corporate bond rating. Historically, municipal bond default rates have been low, as we show later in this section. Context is important, however, when comparing municipal bond vs. corporate bond default rates. From October 2010 until 2021, 93% of municipal bond credits were rated A or higher, compared to 26% for corporate bonds. Of the 14,772 municipal credits rated during this time, 99% were rated investment grade, as shown in Figure 7.

Advice for starting a business from scratch

Each issuer is responsible for their share of the bond’s principal and interest payments, which may not necessarily be equal. Corporate bond investing has come a long way from the 1970s and 1980s, when most bond trades were done over the phone, and investors had little idea on whether they were getting a fair price. In our Where to Buy Bonds article, we discuss how corporate bond trading for individual investors is primarily advantages and disadvantages of bonds conducted online in a competitive and efficient marketplace. Many bonds owned by bond funds are priced well above par value and have little if any capital appreciation opportunities. Many others do not represent compelling risk-reward opportunities relative to other available bonds. Since, due to their size, bond funds seem to own virtually every bond in the market, they own thousands of bonds set to underperform.

- While joint bonds allow for the sharing of liability among issuers, they also entail a shared responsibility for the bond’s debt.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation.

- Bonds, which are loans to governments and businesses that issue them, are often called good investments for older investors who need to rely on steady interest income.

- Lots of things can happen after investing in a bond — some good, some not so good.

Since it’s the money involved, there are certain Disadvantages of investing in bonds the investors or issuers may face at times. Fixed investment in Bonds yields regular interests at timely intervals. Also, once a bond matures, you receive the principal amount invested earlier.

Infrequent and non-uniform financial reports make it difficult for investors to compare the relative value of one muni bond to another. This gives further assures investors about the right time for investing in bonds. Based on the clear ratings, you can choose to buy bonds of any issuer with a better face value of bonds.

This can enable the issuers to pursue larger projects or investments, driving growth and value creation. Many investors believe that the Federal Reserve pulls all the strings in the US corporate bond market. While the Fed can have a big influence, corporate bond investors must understand what credit spreads are and how… Many might assume that, given their massive size, bond funds would have greater income security. In a January 12, 2023 article in The Wall Street Journal titled “For Closed-End Fund Investors, Paper Losses Turn Real,” Heather Gillers explains how a PIMCO California municipal bond fund cut dividends by 45%.

What Is a Joint Bond?

Joint bonds can be an attractive financing option for entities with complementary credit profiles, as they allow borrowers to pool their resources and creditworthiness to secure more favorable borrowing terms. Bonds are IOUs an investor purchases from a company for cash with interest. Explore the basics of bond financing, how to use bond financing, and the advantages of bond financing in this lesson. The major advantages of bonds include fixed returns and regular interests.